Content

- Accumulated Depreciation on Balance Sheet

- How to Calculate the Accumulated Depreciation Under the Units of a Production Method

- How Depreciation Works

- Accumulated Depreciation and the Sale of a Business Asset

- Is accumulated depreciation debit or credit?-Video explaining accumulated depreciation as a credit

“Fixed asset” is what finance people call a tangible asset, capital resource, physical asset or depreciable resource. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet over time. It is the total amount of an asset’s cost that has been allocated as depreciation expense since the time that the asset was put into use. It is reported on the balance sheet as a contra asset that reduces the book value of an asset.

Therefore, accumulated depreciation must have a credit balance to be able to properly offset the fixed assets. Thus, it appears accumulated depreciation appears on the immediately below the fixed assets line item within the long-term assets section of the balance sheet as a negative figure.

Accumulated Depreciation on Balance Sheet

Accumulated depreciation is recorded as a contra asset that has a natural credit balance . The balance sheet provides lenders, creditors, investors, and you with a snapshot of your business’s financial position at a point in time. Accounts like accumulated depreciation help paint a more accurate picture of your business’s financial state.

Inflation to cross 30% as rupee depreciation, petrol prices bite: report – Business Recorder

Inflation to cross 30% as rupee depreciation, petrol prices bite: report.

Posted: Mon, 30 Jan 2023 10:02:43 GMT [source]

Each year the account Accumulated Depreciation will be credited for $9,000. Assume that a company has lots of equipment with a total cost of $600,000 that is reported in the asset account Equipment. The company’s total amount of accumulated depreciation is $380,000 which appears as a credit balance https://online-accounting.net/ in the contra asset account Accumulated Depreciation. Each year the contra-asset account, referred to as accumulated depreciation, increases by $10,000. It is credited each year as the asset’s value is written off and remains on the books, reducing its net value until it is disposed of or sold.

How to Calculate the Accumulated Depreciation Under the Units of a Production Method

However, there are situations when the accumulated depreciation account is debited or eliminated. For example, let’s say an asset has been used for 5 years and has an accumulated depreciation of $100,000 in total.

Is accumulated depreciation a fixed asset?

Accumulated depreciation represents the economic value of an asset that has been used in the past. Although it is reported on the balance sheet under the plant, property, and equipment (PP&E) section, accumulated depreciation is not a fixed asset. It is rather a contra-asset account.

Hence accumulated depreciation is used to reduce the value of fixed assets when the two are netted together. Companies, therefore, record accumulated depreciation on their balance sheet to reduce the gross value of their fixed assets.

How Depreciation Works

The years of use in the accumulated depreciation formula represent the total expected lifespan of an asset. The IRS provides data tables that can show you the expected lifetime value of a particular asset. Once you know the expected years of use, divide the difference between the salvage value and cost by the years of use.

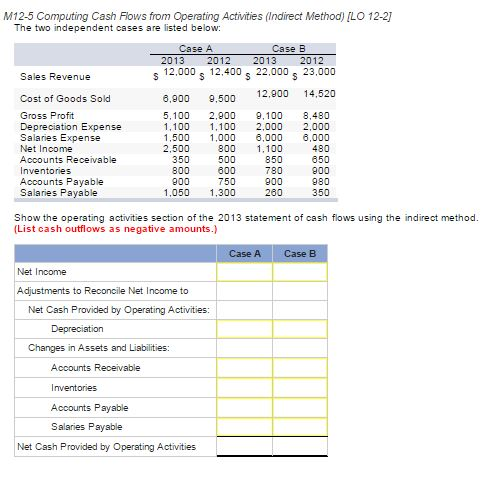

- Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations.

- Accumulated depreciation refers to the life-to-date depreciation that has been recognized that reduces the book value of an asset.

- A fixed asset is any tangible asset that is not easily converted to cash.

- Accumulated depreciation is typically shown in the Fixed Assets or Property, Plant & Equipment section of the balance sheet, as it is a contra-asset account of the company’s fixed assets.